The Philosophy behind Twin Peaks

The proposed Twin Peaks reforms don’t reflect any adverse judgment on the country’s current regulatory architecture, but is aimed at making continuous improvements to the current framework, which proved its worth by helping the domestic sector weather the storm of the global financial crisis better than other jurisdictions.

The FSR Bill first tabled in parliament in October 2015 is due for enactment later this year. The new approach prescribes a shift from the current fragmented regulatory approach to a more complete and comprehensive Twin Peaks Model. It will fundamentally change the way financial services and products are regulated in South Africa, by moving to a more proactive, forward looking and outcomes focused approach.

The FSR Bill will be the first of a series of legislative instruments that will be phased in over time by lawmakers to transform and strengthen the financial system. Not only will it bring local laws in line with international norms but it will also streamline South Africa’s financial architecture to better achieve financial stability and consumer protection.

Countries across the globe including the UK, the Netherlands and Australia have taken different approaches to the Twin Peaks model, all aimed at strengthening prudential and market conduct oversight and stronger consumer protection.

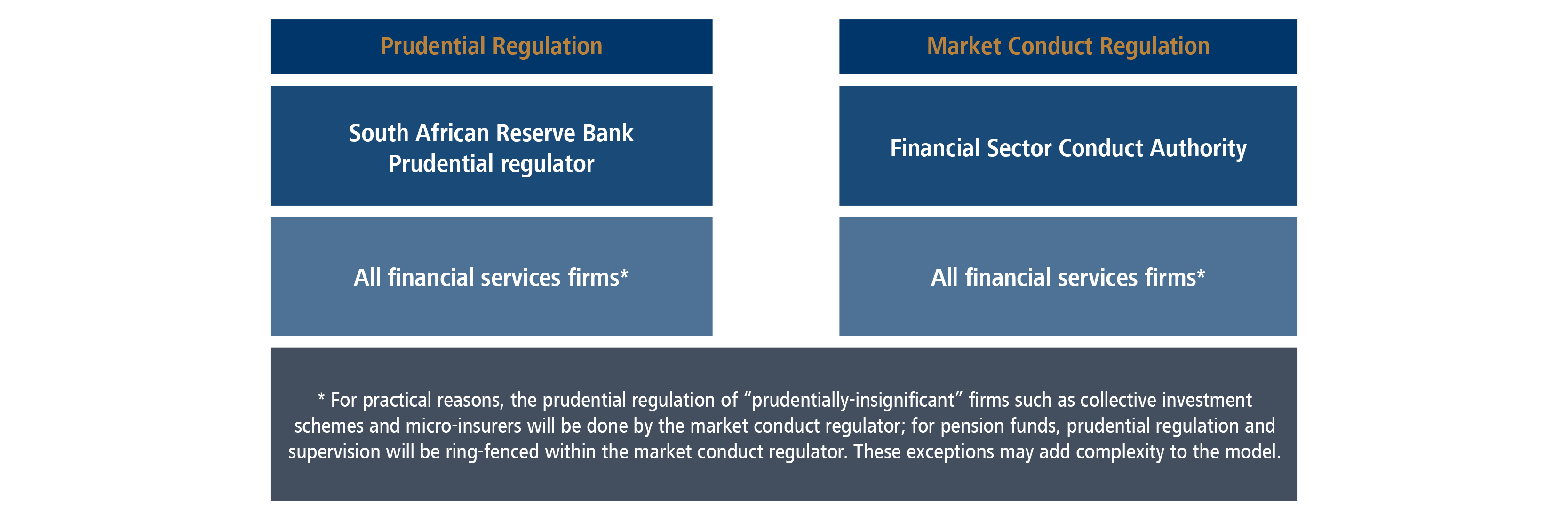

The two-tier premise of separating prudential and market conduct regulation is becoming more prevalent with jurisdictions customising the two-tier approach to cater for their economic needs and development goals.

Twin Peaks will allow for a more dedicated focus on market conduct issues informed by the Treating Customer Fairly (TCF) framework. Under the current legislative framework banks are in the main not regulated for market conduct. "While there is regulatory oversight over intermediary services and advice provided in relation to banking products, there is none over the product or product provider other than in relation to credit provision". Under Twin Peaks, all aspects of banking products and services will be regulated by FSCA.

The Twin Peaks structure of financial sector regulation will also require close coordination between the PA and FSCA. This is given effect to through provisions in the FSR Bill that introduce various formal coordinating mechanisms, such as a requirement to enter into memoranda of understanding. (MoU’s). There is also a general principle of cooperation and coordination entrenched in the Bill, which anticipates a culture of on-going collaboration.

The National Credit Regulator, which currently regulates all retail credit provision, including banks, continues as such in close co-operation with the FSCA.

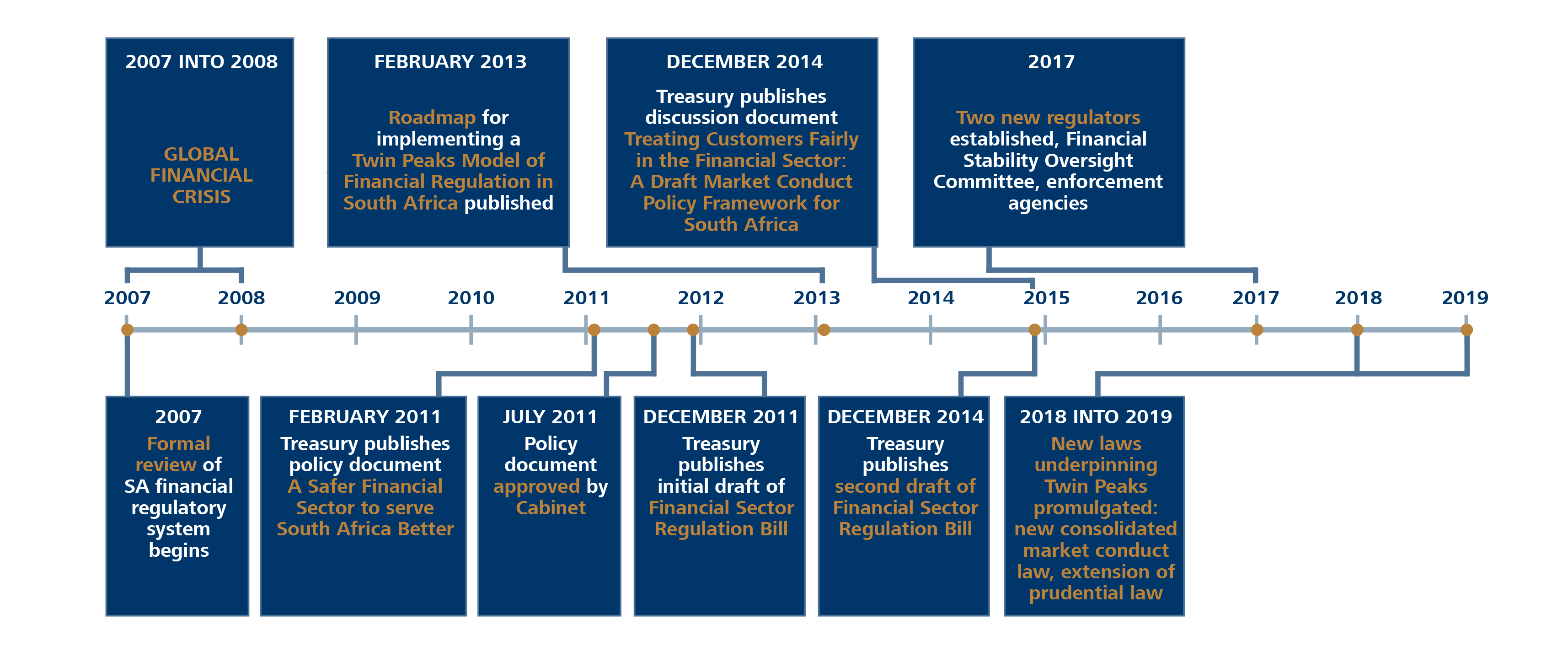

The decision to move to a Twin Peaks structure locally was not taken overnight. The SA government conducted extensive research and went through substantial consultation processes with various stakeholders over a period of more than 8 years before reaching this point.

Industry stakeholders have come out in support of a Twin Peaks approach, recognising that the legislation is an appropriate approach for South Africa, particularly due to the concentrated and interconnected nature of the domestic financial services sector.

South African banks and insurers are highly interconnected, with the insurers supplying substantial liquidity to the banks. From a conduct perspective, these banking and insurance conglomerates offer bundled and interconnected products and services to their customers. It is for these reasons that separating the regulation of the two industries no longer make sense.

Herbert Kawadza, Doctor of Philosophy (Ph.D.), Banking and Finance Law, says that the proposed Twin Peaks approach is both crucial and long overdue for creating an environment that engenders deeper, fair, efficient and transparent financial markets.

“This in turn helps to boost investor confidence in financial markets in South Africa,” he says. “Among other benefits, it assists in creating better supervisory coordination and avoiding financial sector supervisory weaknesses that have characterised most financial regulatory regimes”.

“It is likely to minimise overlaps in overseeing the sector which lead to regulatory arbitrage as well as the risk of “competition in laxity” between regulators”, he notes.

FSR Framework

The FSR Bill intends, among other things, to clearly divide the existing regulatory architecture into a prudential authority that will regulate financial soundness of financial institutions and a separate Financial Sector Conduct Authority, which will be the new face of the FSB.