The empowerment of financial customers is about enabling them to make informed decisions about transacting with financial institutions, and how to hold them accountable should they feel short-changed. Accountability is reciprocal, so most conflicts are best resolved between the parties involved. However, often a deadlock is inevitable, making a fair resolution of complaints only possible if facilitated via an impartial third party. This has been the commendable work of the ombud system in democratic South Africa for years, which has now been further elevated by the recent appointment of the first Ombud Council Board and a Chief Ombud for the Council. This gives effect to a new financial Ombud system in terms of the FSR Act.

The FSR Act includes provisions related to the ombud system, covering all financial product and financial service providers. It also requires financial institutions to be a member of an industry ombud scheme, giving powers to the Ombud Council to allocate a case to the best-suited ombud where no voluntary ombud is available.

The Act also requires the Ombud Council to establish a single point of entry into the ombud system, by clarifying the relationships between the Ombud Council, ombuds, financial institutions and the FSCA, in respect of governance, reporting, respective responsibilities, and cooperation. All ombuds are required to consider the principle of equity and fairness in investigations and decision making (in addition to the laws of contract and financial services).

The objective of the Ombud Council is to ensure that each financial customer can have access to effective, independent, fair and affordable alternative dispute resolution processes for complaints related to their interactions with financial institutions. The Council will recognise industry schemes, set governance procedures, enhance accountability requirements, and align the standards of practice for each Ombud scheme through rule-making and enforcement powers. This will enable it to develop a uniform framework of external dispute resolution mechanisms that can be applied with consistency across the financial services sector.

In its role of overseeing ombud schemes, the Council will effectively become a ‘regulator’ of ombuds; with authority to standardise best practice; promote and coordinate cooperation amongst ombuds.

The Ombud Council will have oversight powers over both the statutory and industry Ombuds, namely:

Office of the Pension Fund Adjudicator

Office of the Ombud for Financial Services Providers (FAIS Ombud)

Office of the Credit Ombud

Ombudsman for Long - Term Insurance

Ombudsman for Short - Term Insurance

Ombudsman for Banking Services

Johannesburg Stock Exchange Ombud

The Finance Minister has since appointed Ms Eileen Meyer as the Chief Ombud for the Ombud Council for a short period. Although a transitional measure, it is significant because the Board of Directors is now quorate and properly constituted for the Ombud Council to commence with its duties.

The Council’s Board of Directors include:

Deanne Wood – Chairperson

Adv Dikeledi Chabedi – Vice Chairperson

Emmanuel Lekgau

Silindile Kubheka

Adam Horowitz

Charmaine Soobramoney

Katherine Gibson will be replaced by Unathi Kamlana, newly appointed FSCA Commissioner.

The establishment of the Ombud Council to transform the financial sector comes with many advantages and expectations. Not only will financial customers enjoy more customer-centric services and products from financial institutions, they will also get better protection from a dispute resolutions process that is effective, independent, fair and timely.

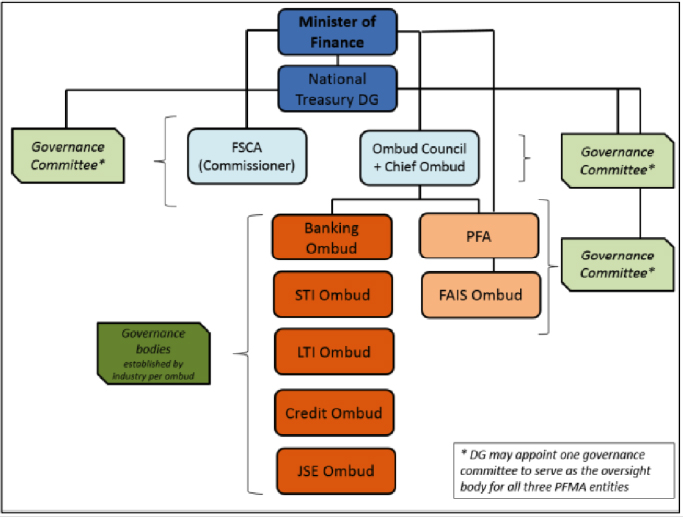

Figure 1: Structure of the ombuds system in the FSR Act