|

The FSCA is aware of on-going efforts by administrators to trace and pay the beneficiaries of unclaimed benefits. According to annual financial statements submitted to the FSCA from 2010 to 2019, R34,3 billion unclaimed benefits were paid to 1,2 million members. In the last 5 years R22 billion was paid to 598 000 members and amounts to an average benefit of R 36978 per member. Below is a breakdown of unclaimed benefits paid to date.

Figure 1: Graph illustrating number of members in occupational funds and members unclaimed benefit funds in 2019

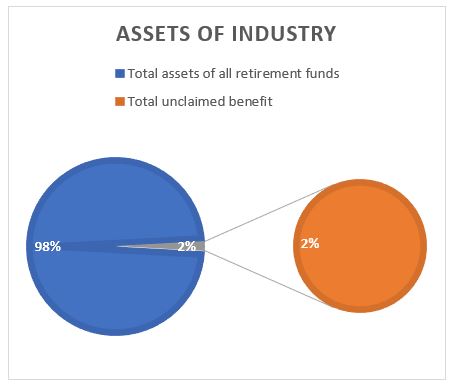

The total assets of unclaimed benefits as a percentage of the total assets of retirement funds increased from 1.67% in 2018 to 1.7% in 2019.

Figure 2: Graph illustrating total assets in retirement fund industry and total unclaimed benefit assets as of 2019

Unclaimed Benefits paid to date

The FSCA is aware of on-going efforts by administrators to trace and pay the beneficiaries of unclaimed benefits. According to annual financial statements submitted to the FSCA from 2010 to 2019, R34,3 billion unclaimed benefits were paid to 1,2 million members. In the last 5 years R22 billion was paid to 598 000 members and amounts to an average benefit of R 36978 per member. Below is a breakdown of unclaimed benefits paid to date.

Figure 3: Unclaimed Benefits paid to date |

|

FSCA led initiatives

In October 2015, the FSCA issued Information Circular 4 of 2015 which requested retirement funds to submit information relating to unclaimed benefits. During August 2017, the Authority launched the Unclaimed Benefit Search Engine, the first of its kind in the financial sector from the information provided. Retirement funds are required to submit updated unclaimed benefits data at least once every three months to ensure that data remains valid and current. We are pleased that the majority of retirement funds are submitting their quarterly data.

Having updated data ensures that the Authority is better able to measure the effectiveness of the system and eliminates frustrations that may arise for both members of the public and retirement funds owing to outdated data in the search engine. Unfortunately, there were some retirement funds who failed to submit the requested information and in May 2021, through a targeted project, the FSCA indicated its intention to issue penalties, in terms of section 267(1) of the Financial Sector Regulation Act, 2017 (FSR Act) to those retirement funds that were found to be non-complaint. The project was highly successful and significantly reduced the number of retirement funds that have not submitted the requested unclaimed benefit information. Further engagements and regulatory action will continue for those retirement funds that have not complied.

Since its implementation, there have been 40 322 possible matches identified and an asset value of approximately R 1.2 billion was paid to 14 558 members after valid claims were submitted to the relevant funds.

The FSCA has a dedicated team of employees who are responsible for assisting members of the public with unclaimed benefits enquiries. Taking regulation to the people (TRP) is another initiative where the FSCA goes to communities to assist with the location of potential unclaimed benefits due to them. This initiative has been paused over the past year or so, due to the Covid-19 pandemic. We have observed that members of the public prefer the face-to-face interactions as it appears our targeted claimants may not be of the generation that is familiar with the electronic platforms available and this may be the reason that unscrupulous tracing agents began to operate in this space. As we go forward industry efforts needs to take observations such as these into account as they impact our success.

Looking Ahead

The Retirement Fund Conduct Supervision department has undertaken the task of sampling funds with the highest unclaimed benefits, thereafter, conducting desktop reviews during the third and fourth quarters of 2020. Some of the insights obtained from this review indicate that there is a lack of a standardised approach to unclaimed benefits; the records of previous efforts to trace beneficiaries are not maintained; there is a lack of competition in the tracing industry and a lack of data integrity checks. The findings of these reviews will in due course be communicated to the retirement funds industry.

Central Unclaimed Benefit Fund

There is also the proposal for a Central Unclaimed Benefit Fund (CUBF) to be established. As you would see from the journey this is not entirely a new concept and has been on the cards for a number of years. The CUBF would be the repository of all unclaimed benefits which would make it easier for members or beneficiaries to claim their benefits, as opposed to not knowing which fund houses their benefits.

Why have a CUBF?

It is contemplated that the CUBF will be compulsory. Some of the advantages of the CUBF will be:

- as a repository of all unclaimed benefits, it would be easier for members and beneficiaries to claim their benefits especially in the event where they do not know which fund houses the benefits, they may be entitled to;

- primary duty will be to trace former members or beneficiaries and effect payment to them;

- A debarment order against a natural person takes effect from the date it is served or at a later date, according to the order;

- members or beneficiaries will have a claim in perpetuity; and

- where the board is unable to find or trace members or beneficiaries such unclaimed benefits may be utilised for social good; e.g. building libraries or schools.

We wish to thank the industry for its participation in various initiatives and efforts aimed at alleviating unclaimed benefits. Unclaimed benefits are not a desirable outcome for a member and as we work towards reducing the number of current unclaimed benefits there should also be equal emphasis on preventing future unclaimed benefits. The FSCA will continue to provide guidance and will strive to create a conducive legislative framework to address unclaimed benefits.

ROLE AND MANDATE OF THE FSCA

Objectives as set out in the Financial Sector Regulator Act, 9 of 2017 that support the FSCA’s role with unclaimed benefits –

- Enhance the efficiency and integrity of financial markets;

- Promote fair customer treatment by financial institutions; and

- Provide financial education and promote financial literacy.

|

|

|