|

Acts, such as the Financial Sector Regulation Act 9 of 2017, FSR, exist for a variety of reasons, primarily to support and safeguard both consumers and financial institutions and to maintain the efficiency and integrity of the financial system. As a customer of any financial institution, you have the responsibility to read through any contract documentation before you sign and commit to anything.

Regulatory bodies such as the FSCA always urge consumers to deal with registered financial service providers. You are entitled to ask for their licence and need to make sure that you ask any questions or voice any concerns about a new policy or plan you are taking out.

Being a customer of a financial institution reaches a lot wider than being a banking customer. A financial institution is an organisation that deals with financial transactions which can also include pensions, insurance, investment, credit, tax, motor or medical plans.

As consumers, you also have the right to complain if you have a dispute with any financial institution. Knowing how, where and who to complain to is critical.

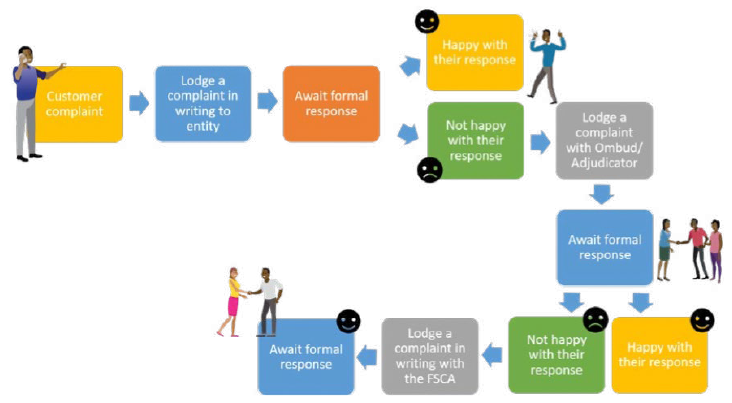

Generally, there are three steps to take when you have a dispute. These include the initial step of complaining to the financial institution itself, taking up the complaint with the relevant ombudsman or adjudicator and then, as a last step, taking your unresolved dispute to the FSCA as regulator.

Here are some useful steps and contact details for anyone who may need to lodge a complaint:

Process 1: Complaints to the entity

Submit a formal written complaint (whether in online form, letter or email) to the entity. You can also approach their internal complaints officer. Enquire about their response timelines and follow up regularly in order to give them their required response timelines. Each institution has their own timeline for responding (approximately 30 working days). If your complaint is not resolved, or if you are unhappy with the outcome, or if you did not receive a response at all, proceed to process 2 of the complaints journey, which is to take your complaint to a specific ombudsman or to the adjudicator.

Process 2: Specific Ombudsman/ Adjudicator Complaints

Depending on the nature of your complaint, you can refer your dispute to the relevant authority such as an ombudsman or adjudicator for free. Submit your dispute in writing (whether in online form, letter or email) and set out the facts as clearly as possible. Submit all supporting documentation to the Ombudsman/Adjudicator, including the correspondence with the entity and await their response. Depending on the nature of the enquiry and third-party response time, the Ombud and the Adjudicator will have different response times. Ask what these response times are and follow up regularly. If your complaint is still not resolved or you are unhappy with the outcome of their investigation, you can proceed to process 3, which is to take your complaint to the FSCA.

Process 3: Regulator – Financial Sector Conduct Authority (FSCA)

Should you still be unsatisfied with the outcomes followed in process 1 and 2, you can approach the FSCA. Submit your dispute in writing (whether in online form, letter or email) and all supporting documentation to the Financial Sector Conduct Authority (FSCA). Await their response. Enquire about the type of query and response time and follow up regularly.

|